Explore the architecture and workings of India's UPI payment system.

The Unified Payments Interface (UPI) for real-time transactions in India is a good case study for other nations in the payment space.

UPI is an instant real-time payment system developed by the National Payments Corporation of India.

It accounts for 60% of digital retail transactions in India today and is still growing.

UPI = payment markup language + standard for interoperable payments

Let’s take a look at how it works.

Bob wants to open an account and provides his phone number +91 12345678

Bob performs OTP (One-Time Password) phone verification

Bob sets up VPA (Virtual Payment Address) bobaxis

Bob’s payment app creates VPA with the acquiring bank

The acquiring bank returns with VPA

The payment app returns VPA to Bob

Bob wants to link his SBI bank account with VPA bob at the axis. The request is forwarded to NPCI (National Payments Corporation of India).

NPCI acts as a switch between acquiring banks and issuing banks. It resolves the account detail from VPA with different issuing banks.

Bob authenticates with account details and sets the PIN, which is used for 2FA. This goes all the way to the issuing bank.

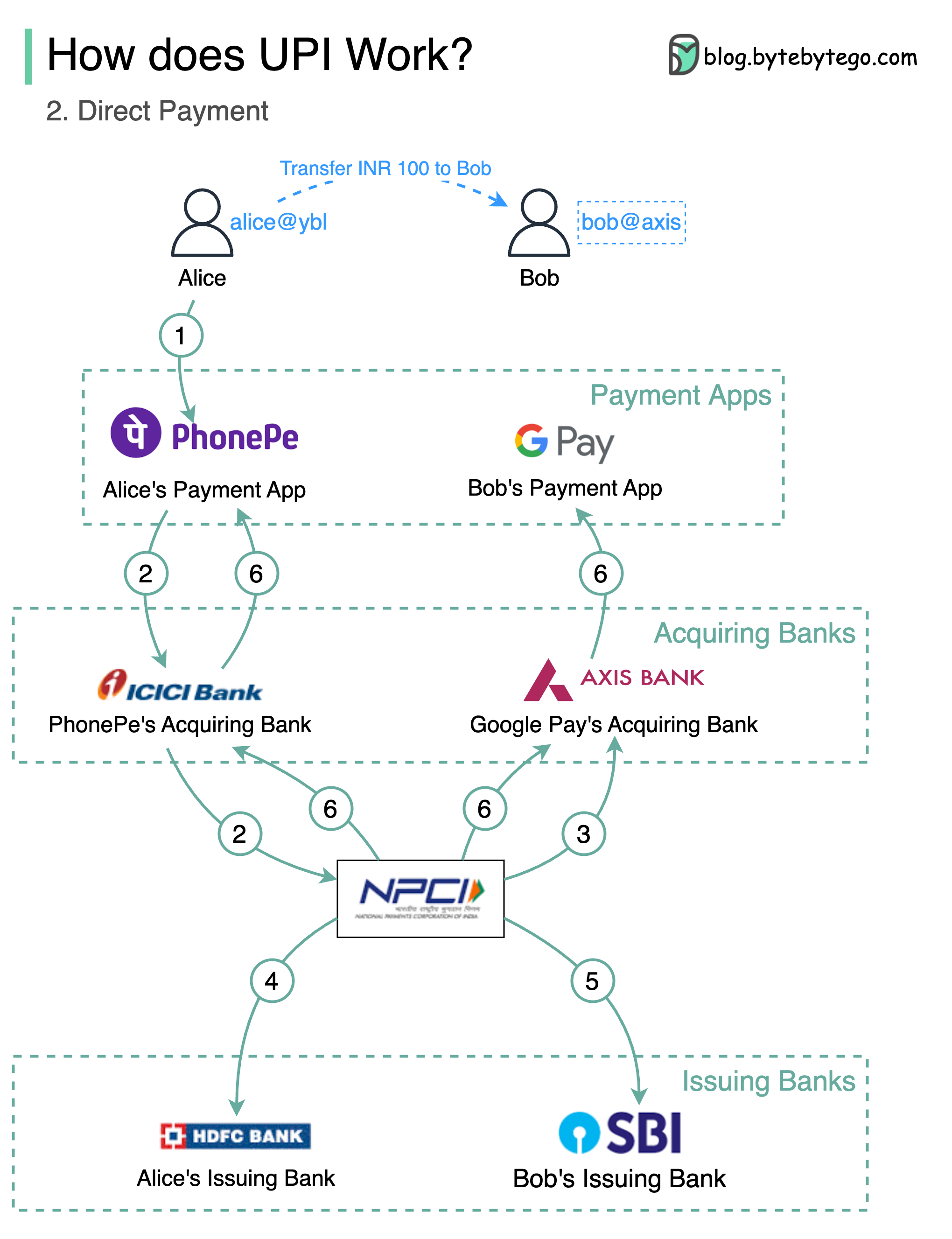

Alice enters Bob’s UPI ID bob and the amount INR 100

PhonePe verifies and forwards the request to NPCI via ICICI bank

NPCI requests Axis Bank to resolve detail for bob at axis

NPCI deducts Alice’s HDFC bank account by INR 100

NPCI sends an instruction to SBI bank and add INR 100 to Bob’s account in SBI bank.

Upon success, NPCI notifies the payment apps via acquiring banks.