Explore the architecture of a low-latency stock exchange system.

How does a modern stock exchange achieve microsecond latency? The principal is:

Do less on the critical path

Fewer tasks on the critical path

Less time on each task

Fewer network hops

Less disk usage

For the stock exchange, the critical path is:

start: an order comes into the order manager

mandatory risk checks

the order gets matched and the execution is sent back

end: the execution comes out of the order manager

Other non-critical tasks should be removed from the critical path.

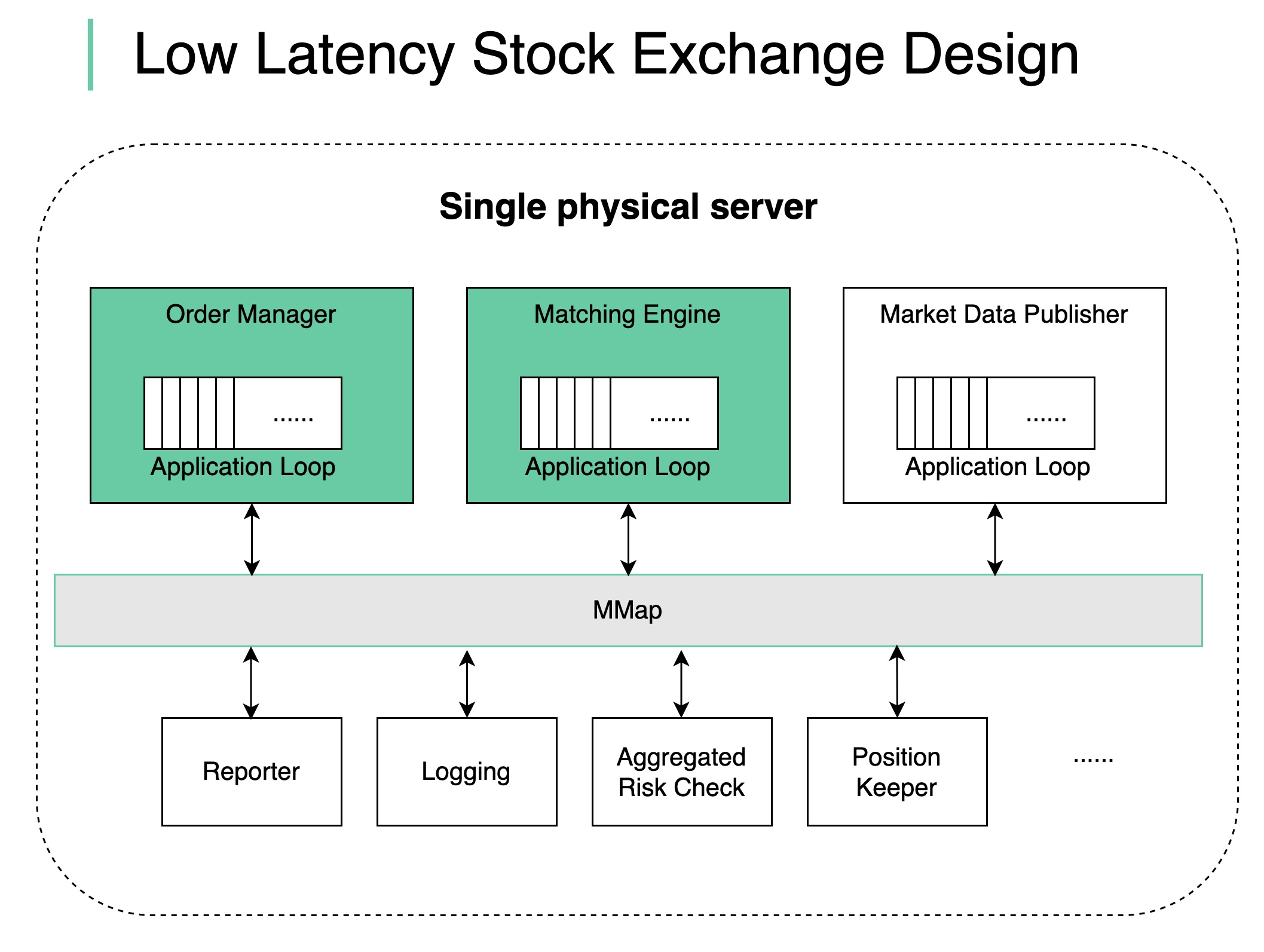

We put together a design as shown in the diagram:

deploy all the components in a single giant server (no containers)

use shared memory as an event bus to communicate among the components, no hard disk

key components like Order Manager and Matching Engine are single-threaded on the critical path, and each pinned to a CPU so that there is no context switch and no locks

the single-threaded application loop executes tasks one by one in sequence

other components listen on the event bus and react accordingly