Explore the mechanics of Apple Pay and Google Pay for secure transactions.

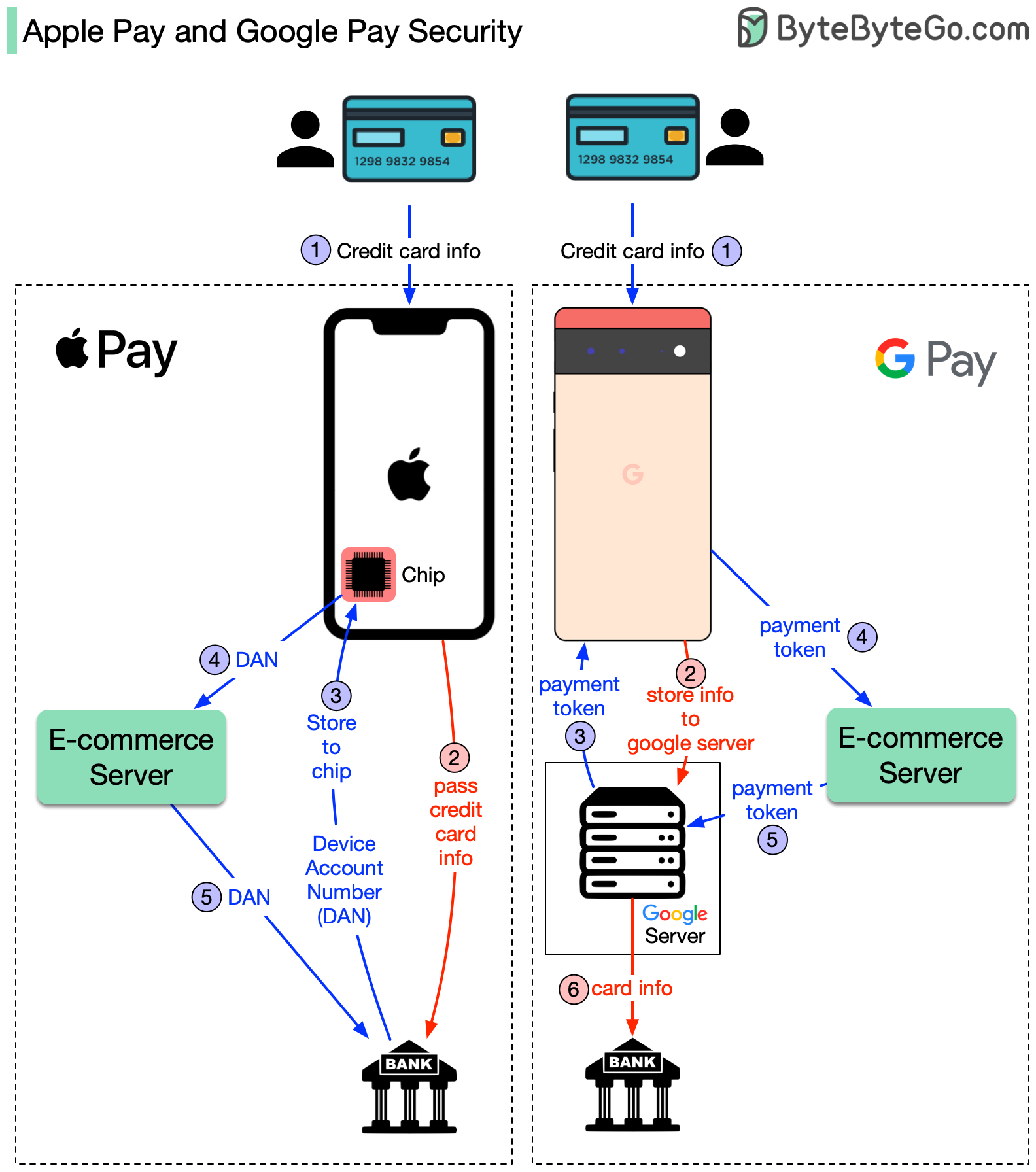

The diagram above shows the differences. Both approaches are very secure, but the implementations are different. To understand the difference, we break down the process into two flows.

Apple Pay: Apple doesn’t store any card info. It passes the card info to the bank. Bank returns a token called DAN (device account number) to the iPhone. iPhone then stores DAN into a special hardware chip.

Google Pay: When you register the credit card with Google Pay, the card info is stored in the Google server. Google returns a payment token to the phone.

Apple Pay: For iPhone, the e-commerce server passes the DAN to the bank.

Google Pay: In the Google Pay case, the e-commerce server passes the payment token to the Google server. Google server looks up the credit card info and passes it to the bank.

In the diagram, the red arrow means the credit card info is available on the public network, although it is encrypted.

References: